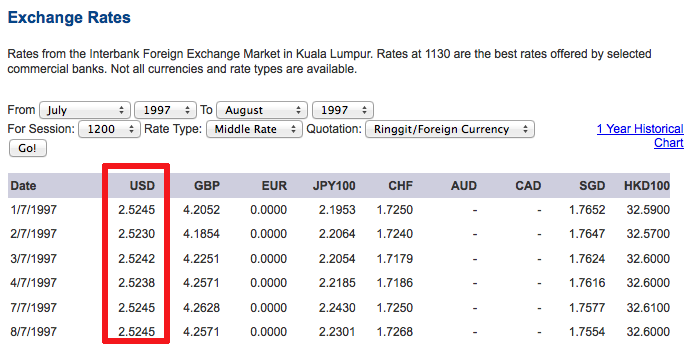

If any component of the customs value is settled in a foreign currency not listed on Monetary Authority of Singapore’s website, that value in foreign currency should be converted to Singapore Dollars using the current selling rate of that currency from reputable sources such as banks in Singapore, local circulated newspapers, reputable news agencies or online resources, at the time when customs duty or excise duty is paid for the imported goods. Foreign currencies not listed in Exchange Rates

Please refer to the guide here on retrieving the weekly average exchange rates. Exchange rates for the period 4 May – are based on the weekly average exchange rates for Period ending from the Monetary Authority of Singapore. To provide facilitation, you may use the weekly average exchange rates, published by the Monetary Authority of Singapore in the preceding week, when making declarations to Customs for the current week.Į.g. However, if Company B is to pay US$10,000 to Company A, then the exchange rate should be used to convert US$10,000 to Singapore Dollars to determine the customs value.

Since Company B paid for the batteries in Singapore Dollars, the amount of S$13,700 should be used to determine the customs value. Which of the 2 currencies should be used to determine the customs value? If any component of the customs value is settled in a foreign currency, that value should be converted to Singapore Dollars using the current selling rate of that currency in Singapore, at the time when customs duty or excise duty is paid for the imported goods.Ĭompany A sold 100 boxes of batteries to Company B at Cost, Insurance and Freight (CIF) US$10,000 but states that payment should be settled in Singapore Dollars at S$13,700.

0 kommentar(er)

0 kommentar(er)